· Dennis Tröger · 4 min read

Inherited Money? Don't Make These 5 Costly Mistakes

Learn how to protect your inheritance by avoiding the 5 most common and costly mistakes people make when receiving a large sum of money.

Getting an inheritance can feel overwhelming. One day you’re living your normal life, and the next you’re managing a sum of money you’ve never dealt with before. While this windfall can open new doors, it can also lead to costly mistakes if you’re not careful.

I’ve seen many people struggle after receiving an inheritance. Here are the five biggest mistakes you need to avoid to protect your newfound wealth.

1. Trusting Bank Advisors Without Question

Your bank might seem like the natural place to go for financial advice. But here’s the truth: bank advisors often push their own products first. They work for the bank, not for you. Their job is to sell bank services, even if those aren’t the best choice for your situation.

Let me share a real example: A client recently showed me a bank’s investment proposal. They wanted a 3-5% advisor fee, a 5% initial sales charge when buying funds, and another 5% exit fee when selling. On a €100,000 inheritance, that means $3,000 gone in advisor fees alone. Add the one-time fees, and you’re losing $8,000 in the first year – before you earned one Dollar. Not to mention the exit fee…

2. Falling for FOMO (Fear of Missing Out)

We’ve all heard stories about someone’s cousin who doubled their money in crypto, or a friend who made it big in real estate. These success stories can make you feel like you’re missing out.

But here’s what people don’t share: their losses. Nobody posts on social media about their failed investments or costly mistakes. Remember, chasing other people’s success stories is a quick way to lose your inheritance.

Ensure you understand which asset types feel good for you and fit your risk-type. For me, real estate always felt like a burden; for others, it’s THE thing.

3. Not Understanding Your Risk Profile

Everyone has a different comfort level with money and risk. For some, losing $10,000 in the market feels devastating. For others, it’s just a normal day of trading.

The key is knowing yourself. There’s no “right” or “wrong” risk level – there’s only what works for you. Your comfort with risk might even change over time. When I started investing, a $100 loss felt huge. Now, I’m comfortable with my portfolio moving thousands of dollars up or down in a day.

4. The Investment Zigzag

Picture trying to drive to a new city without GPS. You’d waste time and gas going back and forth, never sure if you’re heading the right way. That’s what investing without a strategy looks like.

Many people zigzag with their inheritance: buying stocks one day, selling in panic the next, then trying real estate, then going back to stocks. Then they add a bit of crypto…

Without a clear plan, every direction feels wrong because you have no true destination in mind.

5. Playing in the Wrong League

Here’s a mistake I see all the time: people with $100,000 trying to copy the investment strategies of millionaires. It’s like trying to play major league baseball when you’re still learning to bat.

Different amounts of money need different strategies. Someone with $1 million has more room for error and can take bigger risks. They can lose 10% ($100,000) and still be okay. But if you lose 10% of $100,000, that’s a much bigger hit to your financial security.

What To Do Instead

Once you’ve avoided these common pitfalls, you’ll need a solid plan for your inheritance. Consider these resources:

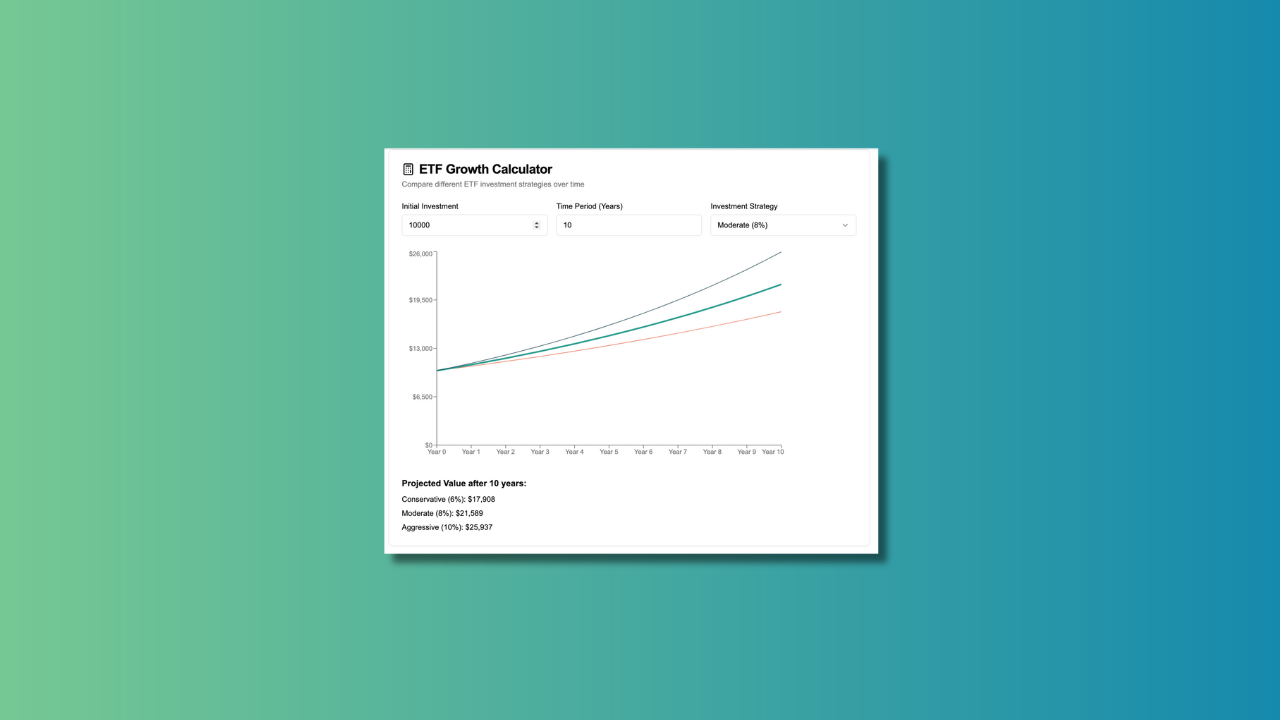

- Learn about the Wealth Triangle framework to structure your inheritance for both security and growth

- If you’re considering investing, read How to Start Investing in 2025 for beginner-friendly advice

- Use the Wealth Canvas to visualize how your inheritance fits into your overall financial picture

First 30 Days

Take time to grieve and process. Keep the money in a high-yield savings account while you develop a plan.

1-3 Months

Consult with independent financial advisors and tax professionals to understand your options.

3-6 Months

Develop a comprehensive financial plan based on your goals and risk tolerance.

Beyond 6 Months

Implement your plan gradually, focusing on long-term growth and security.

Conclusion

Remember, an inheritance is both a responsibility and an opportunity. Take your time, seek qualified advice, and make decisions that align with your long-term goals. By avoiding these five common mistakes, you’re already ahead of most people who receive an inheritance.

Your inheritance can be a foundation for financial security and growth if managed wisely. Don’t rush into decisions, and always consider how your choices align with your personal values and financial goals.

Have you received an inheritance? What challenges did you face? Share your experience in the comments below.