ETF Investment Returns: Conservative vs. Aggressive - What's Your Strategy?

Use our interactive tool to see the results of your strategy.

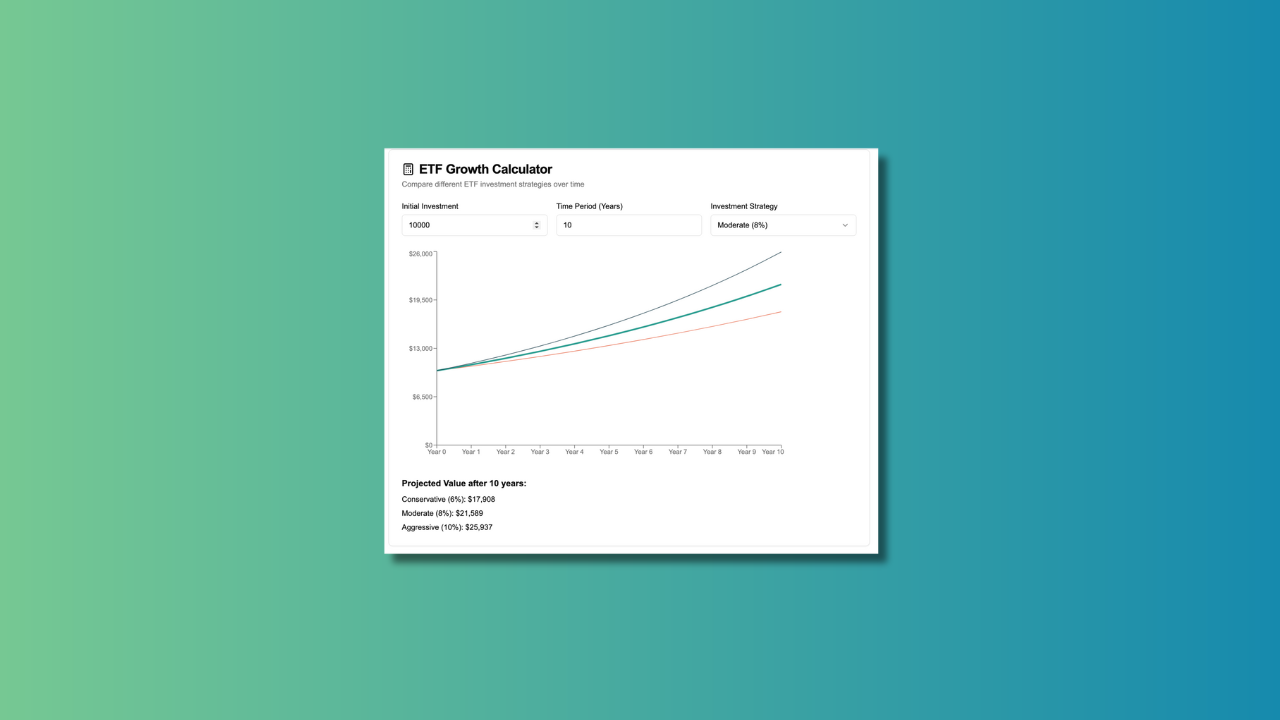

Let's talk about €10,000 and what happens to it over 10 years with different ETF strategies. I've created an ETF Growth Calculator to show you exactly how your investment style affects your returns.

The Three Paths to Growth

Using my calculator, let's look at a €10,000 initial investment over 10 years. We see three distinct paths:

- Conservative (6%): Grows to €17,908

- Moderate (8%): Reaches €21,589

- Aggressive (10%): Expands to €25,937

The difference? A whopping €8,029 between conservative and aggressive approaches. Try it yourself with my free ETF calculator.

What These Numbers Really Mean

The conservative strategy (6%) might be your government bonds and defensive ETFs. Think steady growth, lower stress. You'll sleep well, but your money works less hard.

The moderate path (8%) is your classic world index ETF strategy. It's how I started - broad market exposure without excessive risk. The extra 2% over conservative adds €3,681 to your final amount.

Going aggressive (10%) means adding growth stocks or emerging markets ETFs to your mix. Yes, it could mean more volatility, but also €4,348 more than the moderate strategy.

Making Your Choice

Your strategy choice isn't just about the highest number. Consider:

- When do you need the money?

- Can you stomach seeing your investment drop 20% temporarily?

- Are you investing more money monthly? Test different scenarios in my calculator

Bottom Line

Conservative: €17,908 - Safe but slower growth

Moderate: €21,589 - Balanced approach

Aggressive: €25,937 - Higher potential, higher risk

The best strategy? It's the one that lets you sleep at night while moving toward your goals. Try different scenarios in the calculator and find your comfort zone.

Want to learn more about choosing your investment strategy? Check out my article on The Wealth Triangle for a complete framework.

Disclaimer: This article is based on personal experience and should not be considered financial advice. Always consult with a qualified financial advisor before making investment decisions.